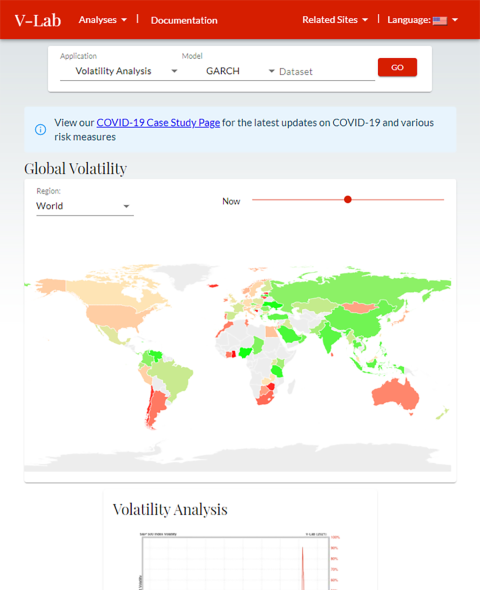

The Volatility and Risk Institute is an interdisciplinary center for research and analysis of financial and nonfinancial risks. It serves as a designated hub to support risk-related research and collaboration among scholars, practitioners, and policymakers. It supports, promotes, and facilitates risk analysis, assessment, and measurement, and creates a bridge between faculty research and a specialized group of practitioners and market participants on the cutting-edge of real-world risk issues. To assess and analyze these risks, we are employing new data and analytical tools including those from data science and a wide range of machine learning technologies. Our Faculty Board is composed of members from the Tandon School of Engineering, the Courant Institute of Mathematical Sciences, the Wilf Family Department of Politics in the Faculty of Arts & Science, the Wagner Graduate School of Public Service, the School of Global Public Health, the Law School, and the Stern School of Business. Our focus is on newly emerging forms of risk including climate risk, geopolitical risk, cyber risk, more recently pandemic risk, as well as new topics in financial risk.