Original Research Initiatives

US Boards Gain Expertise in Material ESG Matters

An analysis of environmental, social, and governance-related credentials for Fortune 100 board members from 2018 to 2023 shows significant improvement, and continued vulnerability in ESG expertise.

A Best Practice Guide to Effective Sustainability Communications

CSB and Edelman released new, first-of-its-kind research, "Effective Sustainability Communications: A Best Practice Guide for Brands & Marketers," uncovering which environmental sustainability claims are most motivating to consumers. Results demonstrate that sustainability messages can have a powerful amplifier effect, increasing brand reach and relevance.

Sustainability Marketing and Consumer Trends

The 2022 Sustainable Share Market Index™ examines point-of-sale data from Circana (formerly IRI) and reveals that products marketed as sustainable are responsible for more than one-third of the growth in consumer packaged goods (CPG) from 2015 to 2022, and that this growth continues despite inflationary pressures.

Financing a More Sustainable New York City

The Invest NYC SDG Initiative aims to support New York City in its work to achieve the UN Sustainable Development Goals (SDGs). Through extensive research and outreach, CSB engages the private sector and drives financing toward creating a more sustainable, inclusive and resilient city.

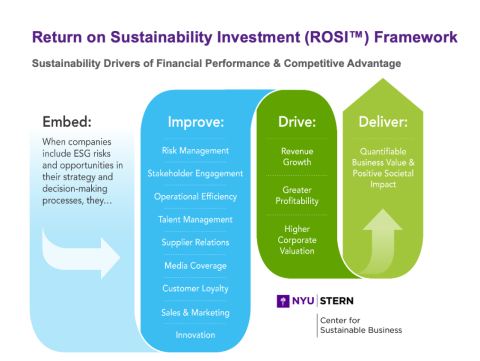

ESG & Financial Performance

Integrating ESG in the Quarterly Earnings Call

In collaboration with CEO Investor Forum, this research addresses the urgent need for companies to place greater emphasis on sustainability, resiliency, and long-term value creation in the quarterly call as a means to move away from short-termism.

2023 Impact Investors Report

This database provides a detailed view into the 150+ venture capital and impact investment firms making investments in sustainability-related startups and next-stage businesses. This tool gives social entrepreneurs and leaders of sustainable businesses an overview of where VC funding is being directed to enable them to identify companies and make connections. Investors can be identified by location, investment stage, total committed capital, assets under management, and total number of investors